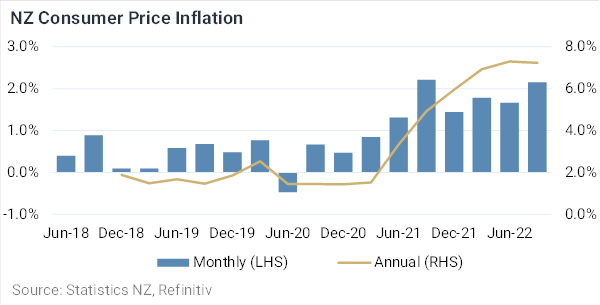

Consumer Price Index (CPI) inflation for the September quarter blasted prior expectations, with a meaty quarterly rise of 2.2 per cent and annual inflation at 7.2 per cent.

The main contributor to the quarterly lift in consumer prices was food prices, which rose 4.1 per cent, boosted by a 17 per cent rise in fresh fruit and vegetable prices.

Housing again contributed substantially to the quarterly rise in prices, with the housing and household utilities component of the CPI rising 2.3 per cent in the quarter. Rising home ownership prices were again a big driver of the rise in the housing component, but recent property rate increases also impacted – up 7 per cent for the quarter.

Transport services prices rose a whopping 18 per cent in the quarter due to sharp airfare price rises as the borders reopened and New Zealanders engaged in more domestic and international travel.

The only significant factor putting downward pressure on consumer prices in the September quarter was a fall in petrol prices, which led to a 2.5 per cent fall in the private transport and supplies component of the CPI.

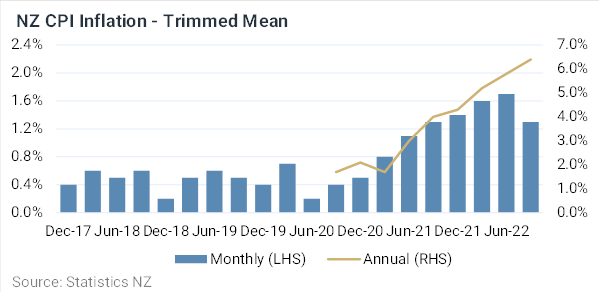

Measures of underlying inflation leapt, with trimmed mean annual inflation measures (which ignore the most extreme positive and negative components) running between 6.4 per cent to 7.0 per cent. Annual CPI inflation excluding food, household energy and vehicle fuels was 6.3 per cent, up from 6.1 per cent in June.

The September quarter inflation result indicates inflation pressures are significantly stronger than expected. There are two significant temporary factors that combined to boost quarterly inflation beyond what most people expected:

- A steep rise in food and vegetable prices, which was caused by a wet winter and poor growing conditions.

- A very large increase in airfares as people re-engaged with domestic and international travel.

Both these factors should largely be temporary drivers of inflation. Nevertheless, trimmed mean and other measures of underlying inflation are running hot suggesting inflation is not cooling as many would hope.

The inflation outcome piles further pressure on the Reserve Bank to continue its forceful Official Cash Rate (OCR) rises, with another 50 basis point hike almost certain when it next meets on 23 November. There are likely to be some on the Monetary Policy Committee that push for a 75 basis point OCR rise at the next meeting, given that option was discussed at its most recent meeting. If the September quarter labour market data shows continued heat with faster-than-expected wage growth, we would err towards expecting 75 basis points too.

However, at this stage, we would expect the Committee to stick to a 50 basis point hike in November but will likely indicate in its November Monetary Policy Statement further chunky OCR rises through the first half of 2023.

Given the September CPI result revealed today and the latest evidence on the economy, we expect the OCR to peak at 4.75 per cent in the middle of 2023.

John Carran is an Investment Strategist and Economist at Jarden. The information and commentary in this article are provided for general information purposes only. It reflects views and research available at the time of publication, using external sources, systems and other data and information we believe to be accurate, complete and reliable at the time of preparation. We make no representation or warranty as to the accuracy, correctness and completeness of that information, and will not be liable or responsible for any error or omission. It is not to be relied upon as a basis for making any investment decision. Please seek specific investment advice before making any investment decision or taking any action. Jarden Securities Limited is an NZX Firm. A financial advice provider disclosure statement is available free of charge here.